24 July 2025

White Papers

Methodology and results from a study on the efficacy and ROI of the Ting fire prevention program

Overview

Whisker Labs, in collaboration with Octagram Analytics and the Insurance Information Institute (Triple-I), conducted a large-scale study titled “The Efficacy and Return on Investment of Loss Prevention Programs – Background, Methods and Results“ to quantify the fire prevention efficacy and economic impact of the Ting smart sensor and fire prevention program. Ting is an electrical fire prevention solution designed to detect hidden electrical hazards through high-frequency voltage monitoring.

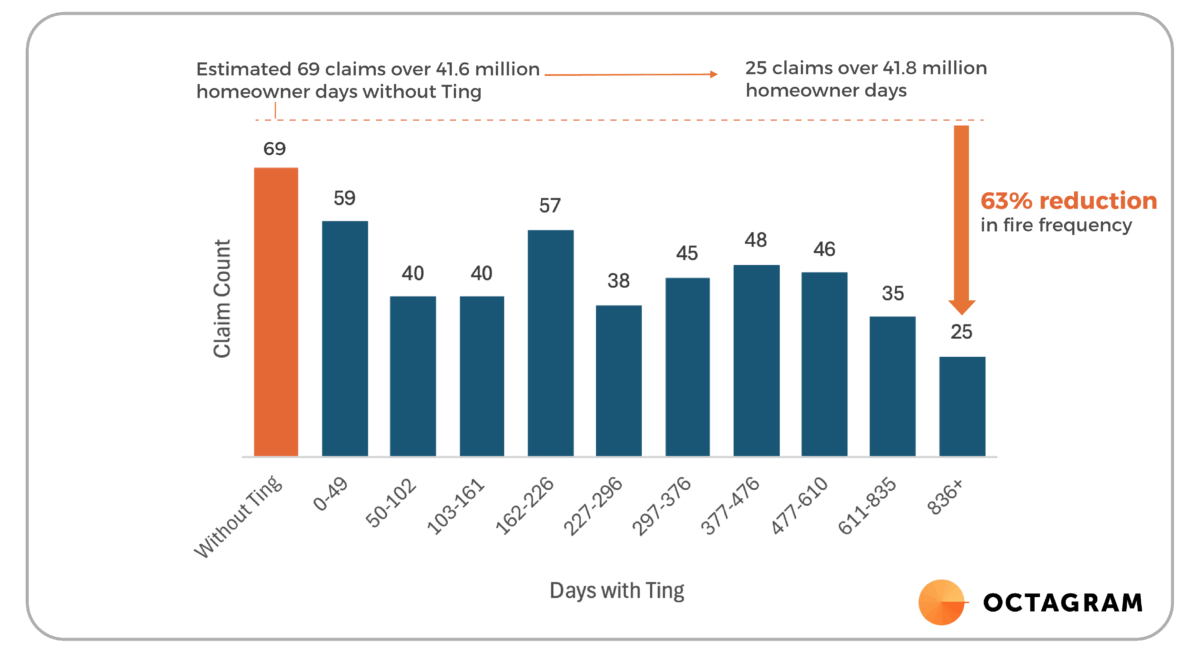

Over a dataset spanning 1.1 million home-years of experience and 433 fire claims, the study applied a self-controlled methodology to measure claim frequency reduction over time within the same cohort of insured homes.

Key Findings

- Ting Results in $81 Fire Claims Reduction Benefit

Ting delivers a measurable $81 annual fire claims reduction benefit per home by year three of deployment. This figure represents the average value of avoided fire claims, calculated by combining a reduction in claim frequency with industry-based estimates of fire loss severity. - Ting Reduces Fire Claims by 0.39 Claims per 1,000 Home-years

Specifically, claims dropped from 0.61 claims per 1,000 home-years in the initial monitoring period to 0.22 claims per 1,000 home-years by Year 3, or a 63% reduction in fire frequency.

- The Study Provides a Framework for Evaluating Other Prevention Technologies

The study introduces a self-controlled, time-based analysis approach that minimizes sampling bias and requires limited claims detail. This methodology is broadly applicable to other smart home and IoT-based prevention technologies, offering insurers and researchers a scalable and repeatable framework to assess claims reduction and return on investment across risk-types such as water damage, theft, and non-weather-related losses.

Methodological Approach

The study addressed several challenges commonly encountered in evaluating loss prevention solutions:

- Low Claim Frequency

Residential fire claims are infrequent (approximately 1 in 700 homes annually[1]), requiring a large volume of exposure data to achieve statistical significance. - Incomplete Cause Attribution

Secondary causes of fire claims are frequently unclassified in insurer data, complicating efforts to isolate only electrical fire incidents. The study therefore included a broad category of non-catastrophic fire claims to avoid inaccuracies due to misclassification. - Sampling Bias

Many prevention solutions are deployed through opt-in programs, creating bias in comparing treated and untreated populations. The study design used a self-controlled approach, analyzing claim behavior over time within the same set of homes.

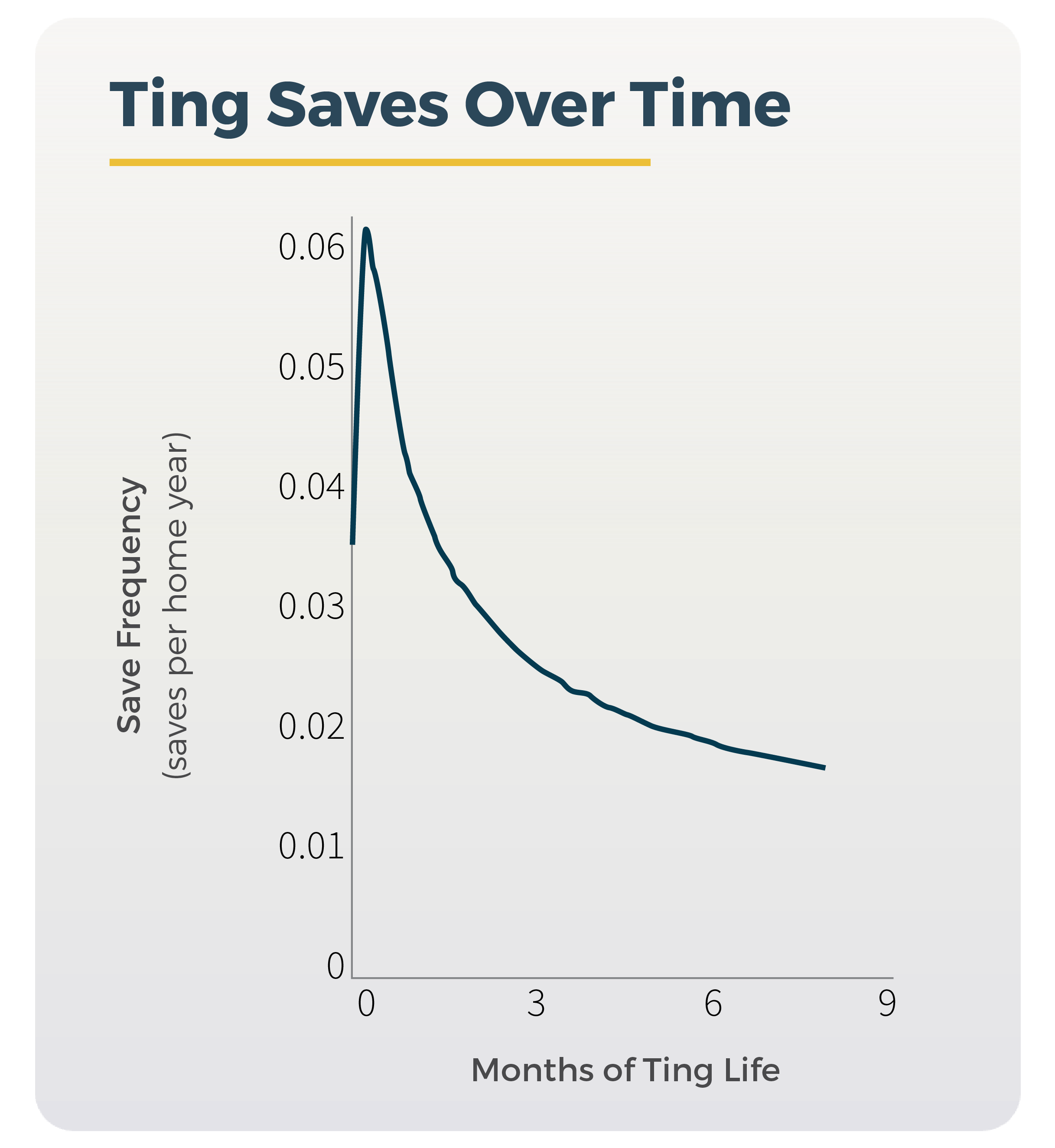

Claims data were grouped into deciles of equal home-days of exposure. This allowed for observation of trends in claim frequency as a function of time elapsed since Ting installation. Initial periods were interpreted as a baseline, recognizing a “learning phase” during which Ting calibrates hazard detection.

Observed Trends

- The decline in claim frequency persisted consistently across the dataset and independent carrier analyses.

- Analysis shows that a large share of electrical fire hazards are detected within the first 49 days after Ting installation, indicating the presence of preexisting latent hazards.

- Despite the initial reduction, homes continued to experience fire hazards over time, indicating an ongoing need for monitoring.

Limitations and Areas for Future Research

Several uncertainties remain:

- Baseline Claim Frequency Estimation

The claim frequency prior to Ting installation had to be extrapolated from the early monitoring period. Additional pre-installation claims data could further refine this estimate. - Severity Assumptions

Claim severity estimates are based on Verisk’s national non-catastrophe fire data and insurer input. Future analyses incorporating more granular claims data could improve accuracy. - Home Characteristics

The study assumed comparable risk profiles across time bins. Incorporating factors such as home age or occupancy characteristics could further isolate Ting’s impact. - Non-Fire Loss Prevention

While Ting also provides alerts related to water losses and power quality issues, the study did not attempt to quantify these benefits. Similar methodologies could be applied with sufficient claims data.

Conclusion

The study demonstrates that Ting deployment is associated with a statistically significant reduction in the frequency of non-catastrophic residential fire claims over a multi-year period, yielding a measurable economic benefit. The results offer a credible framework for evaluating the return on investment for IoT-based prevention solutions.

This approach may serve as a valuable reference model for insurers and solution providers evaluating technologies designed to prevent loss before it occurs. At Whisker Labs, our mission is to prevent losses before they happen. Behind every data point represents a family, a home, a life protected. Studies like this help advance a future where prevention is prioritized, measurable, and scalable.

About This Study

Whisker Labs, Inc. is dedicated to helping insurance companies predict and prevent electrical fires and water losses. Understanding the efficacy of peril-based risk mitigation solutions is fundamental to our business.

We’ve sought to develop robust methods for credible evaluation of efficacy and associated ROI. This efficacy and ROI evaluation was conducted in partnership with Octagram, providing independent data analysis and modeling, and Triple-I, contributing insurance industry expertise and contextual insight.

Contributors Include (listed alphabetically):

James Anderson, SVP Sales and Business Development, Whisker Labs

Stan Heckman, Chief Scientist, Whisker Labs

Mike Kalten, CFO, Whisker Labs

Jessica Leong, CEO, Octagram Analytics

Kristie Lewis, VP Marketing, Whisker Labs

Robert Marshall, CEO and Cofounder, Whisker Labs

William Nibbelin, Senior Research Actuary, Insurance Information Institute

Dale Porfilio, Chief Insurance Officer, Insurance Information Institute

.

Sources

[1] Verisk | ISO Fire Non-Cat frequency 2020-2024 average is 0.14 per 100 home years, which implies 1 in 700 ~ (1/0.0014). https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

Latest Posts

Introducing Frozen Pipe Alerts and Early Prevention with Ting

December 4, 2025

How Effective Are Loss Prevention Programs for Insurers?

July 24, 2025

Analysis of Total Harmonic Distortion on the U.S. Electric Grid

November 11, 2024

8,000 Families and Homes Saved from Potential Fires

January 31, 2024

New Data: Home Electrical Fire Prevention

March 1, 2022

New Data: Home Electrical Fire Prevention

March 1, 2022